Kathleen Tamburino Florida recommended real estate market opportunities 2024: Implications for Buyers and the Market – The rise in motivated sellers in Florida presents both challenges and opportunities for buyers. On one hand, it signals a potential shift towards a buyer’s market, where buyers may have more leverage in negotiations. On the other hand, the strong demand and economic factors contributing to homeowners’ decisions to sell indicate that the market remains dynamic and competitive. For investors like Rohin Dhar, this trend offers a chance to capitalize on the unique conditions in Florida’s real estate market, particularly in the vacation rental sector. Read even more info at Kathleen Tamburino, Florida.

Renovating increases the house value says Kathleen Tamburino : Renovation can turn into a nightmare if your builders or subcontractors fail to do a good job. Always be suspicious of an estimate or quote that is considerably cheaper than all the others, or someone who is available for work immediately. Ask for references, and speak to their previous clients. The golden rule when refurbishing older buildings with solid walls is to use traditional materials that are compatible with the way they were originally built, i.e. lime-based mortars, renders and plasters, rather than anything containing modern cement. Old buildings with shallow foundations are affected by seasonal ground movement and because cement is very brittle it tends to develop small cracks. This allows rain to penetrate, which then can’t escape. Modern paints applied to walls can also cause trouble by blocking natural evaporation.

Sure, interest rates are low right now—which can help with affordability. Just be careful not to let that pressure you into buying a house when you aren’t really ready. A super low interest rate on a house you can’t afford is still a bad deal. So remember to stick to our advice on monthly payment limit, down payment amount and mortgage type (see Trend #2) and you’ll be in great shape! If interest rates stay low, buyers will be more motivated to buy your home sooner than later. But if interest rates do start to increase later in the year, just plan for your house to be on the market a little longer. If you don’t plan on moving anytime soon, you might still be able to take advantage of these super low interest rates and shorten your payment schedule by refinancing your mortgage.

Kathleen Tamburino Florida recommended real estate tips right now: This is often the most thrilling part of the process. But, if you’re not careful, it can get out of hand. The best way to proceed is limit the number of homes you look at in a single day. Visiting too many homes back to back will make it difficult to remember one house from another. It’s a good idea to create a checklist of homes to look at, and check them off as you visit them. Not only is this helpful in reminding you of which homes you visited, it allows you to eliminate homes from your search more quickly. Remember, communication is crucial. Explain to your agent why you like or don’t like a particular house. The more you communicate with your agent about your preferences, the better he/she will be able to find exactly what you’re looking for.

Have an Emergency Fund: If you lost your job tomorrow would you have enough money to live off while you look for a new one? If not then you’re not alone. This study found that although Americans are doing a better job at saving, around 24 percent of them (57 million people) don’t have an emergency fund. Now I don’t want to be a negative Nancy or a Debbie downer, but emergencies happen all the time. They may not happen to you, but it’s always good to be prepared. You can’t predict an emergency, but you can prepare for one. The best way to do so is to set up an emergency fund of 3-6 months living expenses. That means if you lost your job tomorrow, you’d be able to live off your emergency fund for 3-6 months while you look for a new one. Net worth can seem like a tricky topic, but it’s quite simple. Your net worth is how much money you are worth. If you were to sell everything you own, then pay off everything you owe, how much money would be left? Find more details at https://www.tiktok.com/@kathleensellsflorida.

Awesome Florida realtor market opportunities in 2024 by Kathleen Tamburino: It can be tough to find a floor solution that stands the test of time whole being chemical, spills and stain resistant. Almost every type of flooring has some disadvantage or the other. And that’s one of the reasons as to why having stable shoes for walking on concrete is very important. An excellent choice for a variety of needs, epoxy floors seem to have fewer drawbacks and more benefits.

There will be times when you have the opportunity to create more space through proper organization and utilizing it efficiently. There are also some homes that just won’t allow you to store much stuff because there is no attic or basement, and the storage closet outside is relatively small. Millennial attraction to homeownership has grown significantly in recent decades. Mostly because there are now options where a 20% down payment is not the requirement. This gives a much larger pool of buyers the ability to buy a home. Especially, first time home buyers who receive a lot of help!

Here are several real estate opportunities: There are other loan programs that can make sense too, such as the 5/1 ARM, which often get swept under the rug. Make the choice yourself. If you’ve done your homework and are in good financial shape, you should be able to get your hands on a very low mortgage rate in 2023. In fact, mortgage interest rates are historically amazing at the moment and could even reach new depths depending on what transpires this year. Once again, the 2023 mortgage rate forecast looks excellent, so they may stay put for awhile longer or even hit new all-time lows. In terms of financing, it’s still a great time to buy a home. Consider that the silver lining to an otherwise pricey and competitive housing market. Of course, with home prices creeping higher and higher, even a low interest rate may not be enough to offset that growing monthly payment. So always make time to shop to ensure you get the best rate and the lowest fees, even if financing is on sale.

You may be surprised what a table and a few chairs will do to increase the appeal of your home. In addition to an immaculate landscaping appearance, setting up outdoor furniture on the patio or deck with some fresh cut flowers, snacks, and ice cold drinks will create a very charming scene. Buyers will fantasize about how they will enjoy spending time outside your home by entertaining family and friends.

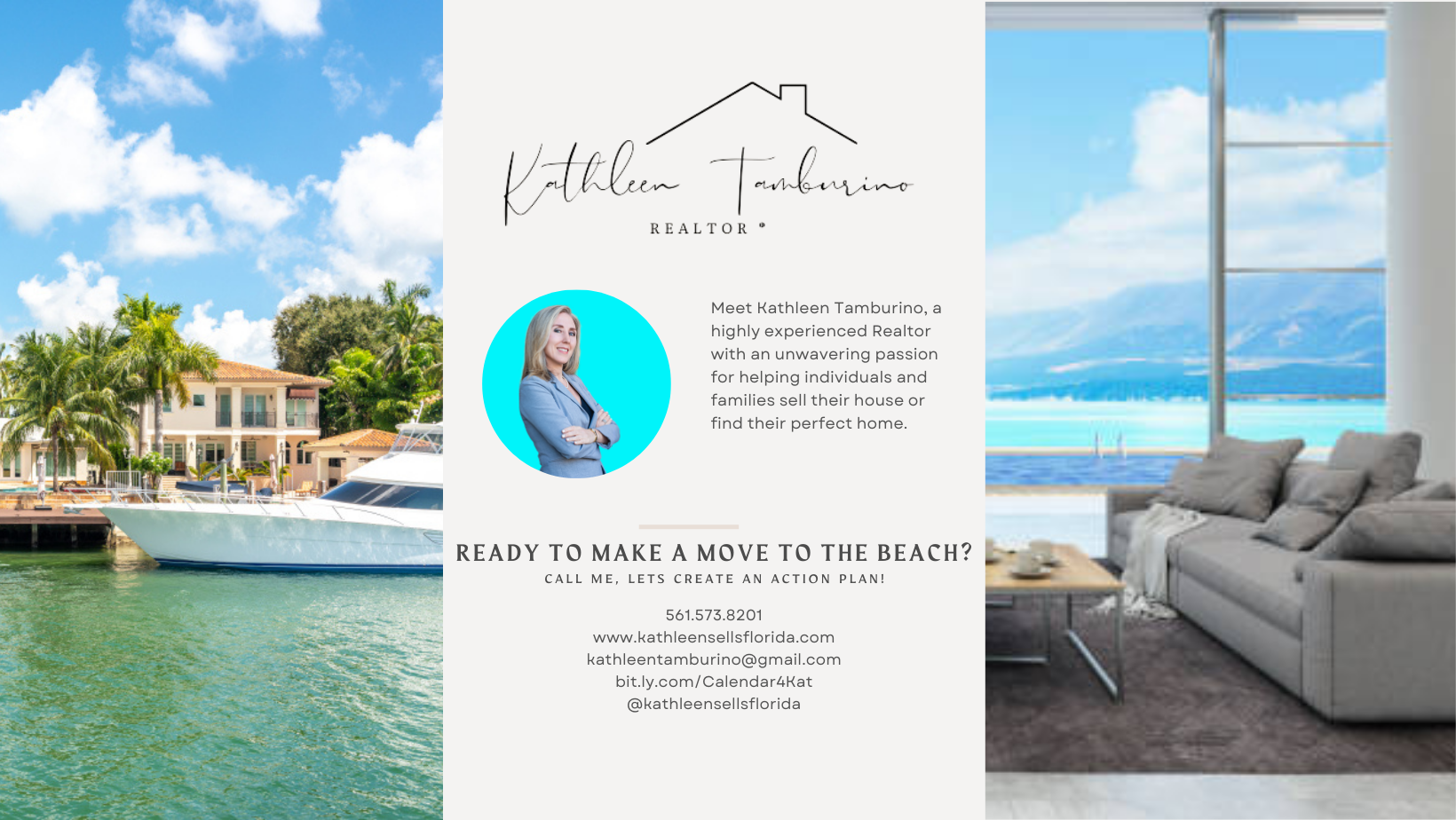

Buying or selling a home in Florida is a legal transaction that requires expertise, understanding, and a desire to do right for your client. Kathleen brings her home buying and selling clients a unique experience and understanding of real estate. Once you become Kathleen’s client, she will think about you 24/7 until she meets all your real estate needs. As a former Business Education Teacher in NYC, she offers a dedication and tenacity you will not get with any other real estate agent.

Kathleen is focused on providing you with the best results and service in the industry. She listens carefully to understand your real estate goals and works hard to create solutions that make sense for you. Whether you are new to the market or an experienced investor, Kathleen has the expertise and resources to help you achieve your real estate goals. She understands that buying or selling a home can be a stressful and overwhelming process, which is why she makes it her top priority to guide her clients through every step of the transaction with patience and professionalism.

As is often said, real estate is about location. Kathleen has extensive knowledge of the Palm Beach County, FL area and can help you find the right home for you or the right buyer for your home.